Are you a business owner in the world of e-commerce and feeling overwhelmed by all the financial responsibilities your business has to deal with? One important factor that is vital to success for every online shop is having a bookkeeping process which accurately tracks and keeps track of every sale, each payment received, expenses made, and taxes due. In terms of accounting reports including tax returns that are filed at the close of each calendar year, and analyzing the flow of cash, bookkeeping can be extremely helpful.

Being successful in the ecommerce industry is more than good products and marketing strategies. To ensure that the business is profitable and compliance financial management plays an essential part behind the scene. This article will cover the most important aspects of finance in ecommerce like bookkeeping, accounting and tax preparation. Understanding and mastering this element is crucial for sustained growth in today’s competitive e-commerce business environment.

Bookkeeping is the core of sound financial management for companies that operate online. This involves recording and arranging financial transactions such as expenses, sales, and inventory. By keeping accurate and current data, entrepreneurs of e-commerce gain valuable insights on their company’s financial condition. Bookkeeping lets them monitor the flow of cash, monitor expenses and sales and make informed decisions using real-time information. For more information, click ecommerce

All businesses that are involved in e-commerce require efficient bookkeeping processes. Here are a few important strategies for streamlining your bookkeeping procedures:

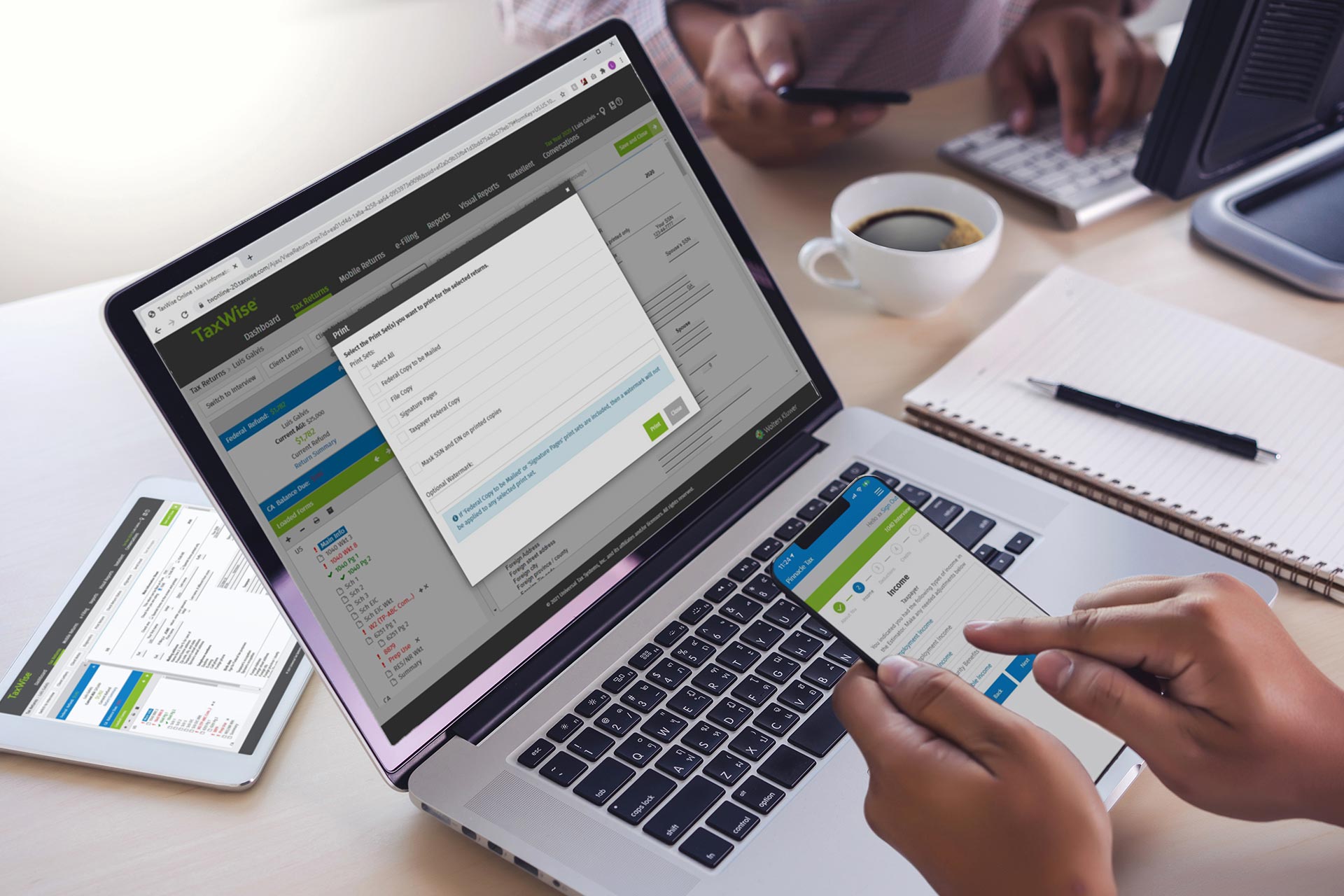

Make use of Accounting Software Make sure you invest in a robust accounting software that is specifically designed for companies that operate on e-commerce. These software tools can automate the process of data entry create reports, as well as offer integrations with payment gateways, as well as other platforms.

Separate Personal and Business Finances It is crucial to separate your bank accounts and credit cards for your online business. This makes bookkeeping easier and makes tax preparation easier. This also guarantees precise financial reports.

Classify Transactions: Correctly categorizing transactions helps you understand your revenues and expenses better. Separate categories are created for advertising costs, shipping expenses, sales and other relevant expenses.

Tax preparation is a critical element of managing the financials of an e-commerce business. Ecommerce companies must conform to tax regulations as well as collect and pay the sales tax, if applicable. They are also required to submit tax returns in a timely manner. Consider these factors for effective tax planning:

Sales Tax Compliance: Understand the requirements for sales tax in the states where you offer products. Consider whether you have nexus (a substantial presence) in those states and should you collect and remit sales tax.

Keep meticulous record of your transactions. Make sure you keep detailed records of all your transactions, like sales, tax payments and expenses. Document any deductions or exemptions you might be entitled to.

Consult a tax professional: Ecommerce taxes can be complicated. You should consider consulting with a qualified tax advisor who has expertise in the e-commerce industry to ensure that you are in compliance with the law.

Accounting is more than bookkeeping and tax preparation. It involves analysing financial data as well as generating financial statements as well as providing a complete overview of your ecommerce business’s financial performance. Here’s why accounting is essential:

Accounting Analysis: Using the accounting process, you can examine your ecommerce business’s financial performance examine profitability, find trends, and make informed decisions for growth.

Budgeting forecasting, budgeting, and financial Goals: Accounting allows you to prepare budgets and financial goals as well as forecast future performance. This enables you to manage resources effectively.

Financial Reporting: Through the production of financial statements such as income statements and balance sheets and cash flow reports, you can communicate the financial status of your business to lenders and investors.

As your online business expands it becomes more complex to manage financial tasks that can become overwhelming. Outsourcing accounting and bookkeeping services has many benefits.

Accuracy and Expertise: Professional bookkeepers and accountants specialize in the area of eCommerce finance making sure that accurate records are maintained as well as financial statements.

Save time and money by outsourcing your financial services, you can focus on the core operations of your company while experts manage them. It’s also more cost-effective compared to hiring in-house staff.

The profit of your website’s e-commerce business will be maximized if you have a solid bookkeeping program in place. While it may be difficult and time-consuming to establish the bookkeeping system and track your expenses. Additionally, you will gain useful insights into areas in which you could improve efficiency or increase sales. A reputable accounting firm can assist you in setting an effective bookkeeping system for your business. This will ensure that the business is properly positioned for success. If you’re overwhelmed or don’t have sufficient resources at hand and need help, seek out assistance from a dependable service. This could lead to a new world of possibilities which will benefit your company as of now and into the future. So why wait? Use these powerful tools today and use them to increase your business’s profitability unlike any other time!

Leave a Reply